Monday Was One of the Biggest One-Day Rallies In the History of the Stock Market

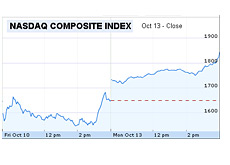

The major North American market indexes posted some of their biggest one-day gains ever on Monday as optimism returned to the markets and stocks roared higher. The Dow Jones Industrial Average soared over 900 points on Monday, which works out to be a gain of 11.08%. The Nasdaq Composite added almost 200 points, while the S&P 500 added just over 104 points, which was good for a one-day gain of 11.58%.

The major North American market indexes posted some of their biggest one-day gains ever on Monday as optimism returned to the markets and stocks roared higher. The Dow Jones Industrial Average soared over 900 points on Monday, which works out to be a gain of 11.08%. The Nasdaq Composite added almost 200 points, while the S&P 500 added just over 104 points, which was good for a one-day gain of 11.58%. Monday, October 13th, 2008 was one of the strongest one-day performances in the history of the stock market. The Dow traded up over 936 points, which easily qualified as the single biggest one-day point advance in the history of the DJIA. In terms of a percentage move, Monday's performance was the fifth strongest one-day performance in the history of the Dow Jones Industrial Average. The strongest ever performance came on March 15th, 1933, when the DJIA surged 15.34%. Today was certainly the strongest performance of the past 60-70 years - the four biggest one-day percentage surges in the history of the DJIA all came during the Great Depression era.

The Nasdaq and the S&P 500 followed suit on Monday, turning in some of the strongest one-day performances in their history as well.

The markets surged after investors cheered some of the aggressive moves that have been undertaken by governments in both the United States and Europe.

The United States announced this weekend that they would be using some of their $700 billion dollar bailout to invest in "healthy" banks. This will result in the US government buying preferred shares in a number of the biggest banks in America in an attempt to restore confidence and shore up the company's capital positions. The United States government will invest in some of the most storied franchises in the world, including Goldman Sachs, JP Morgan, the Bank of America and others. Some of these firms are reported to have balked at such investments by the government, but it has been reported that they don't have any choice in the matter.

The deal will see the government invest billions of dollars into each company. The Treasury is reportedly going to invest $25 billion dollars in both Citigroup and JP Morgan, as well as billions more in Bank of America, Goldman Sachs and others. All of the banks involved with have to submit to compensation restrictions, and all will have their senior unsecured debt guaranteed by the government, according to published reports.

Governments in Europe have also stepped up to resolve the credit crisis by pledging a whopping $1.8 trillion dollars to guarantee bank loans and take stakes in lenders. This will include the governments of France, Germany, Spain, the Netherlands and Austria. Many were stunned by how fast that deal came together and how aggressive it was, and that certainly helped to fan the flames of the markets on Monday.

This two moves certainly helped to propel the markets higher on Monday. These aggressive moves by some of the largest economies in the world will certainly help to ease fears about the credit crisis and overall bank solvency.

In addition to all of this news, many investors and traders simply felt that the selling had come to a short-term end. After gapping down substantially on Friday, the markets clawed their way back and many felt that a short-term bottom had been put in on Friday morning. It remains to be seen whether this was a short-term or long-term bottom.

Many short-sellers were blown out of the water on Monday as well. Perhaps they were caught off-guard by the announcement that the US government would be investing heavily in major companies in the financial sector. Either way, many shorts were crushed on Monday, leading to a great deal of short covering. Those who want to ban short-selling permanently should look at the positive effect that short covering can have on the markets when shorts are caught flat-footed. Sure, many short-sellers have done tremendously well over the past few months, but many new positions were initiated after the ban on short-selling financial firms ended last week. Their covering led to a great deal of added upside on Monday.

Where to from here? Who knows, but one thing is for certain - the markets will be very volatile.

Filed under: General Market News