Simons Helped To Popularize "Quant" Funds

The Wall Street Journal (link below) is reporting that James "Jim" Simons will be retiring as CEO of Renaissance Technologies at the beginning of 2010.

The Wall Street Journal (link below) is reporting that James "Jim" Simons will be retiring as CEO of Renaissance Technologies at the beginning of 2010. In a letter to investors that was sent out this Thursday, Simons announced that current co-Presidents Bob Mercer and Peter Brown would be taking over as Co-CEOs of the company. Simons will remain the firm's principal shareholder, and he will also retain his post as Chairman of the company.

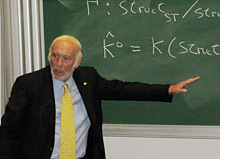

To say that James Simons is a legend in the hedge fund industry is almost an understatement.

The Renaissance Technologies' Medallion Fund has managed to return over 30% per year since 1988, making both Simons and his investors phenomenally wealthy.

Before the 2008 market crash that decimated the hedge fund industry, Renaissance Technologies had a staggering $36 billion dollars under management, which is just a testament to the success that Simons had during his time with the company.

According to various reports, Renaissance Technologies still has nearly $20 billion dollars under management, making it one of the largest hedge funds in the world.

James Simons was a pioneer in both quant and high-speed trading, and his mathematical approach to making money was emulated by many different traders and firms.

Four separate things helped contribute to the legend of Simons as both a person and as a hedge fund manager:

1. His phenomenal returns.

2. His incredible philanthropical work.

3. His reliance on "non-Wall Street" minds, such as mathematicians and computer programmers

4. His desire for his firm to remain as secretive as possible (this likely traces back to his days as a code-breaker with the Institute for Defense Analyses. Sure, hedge funds are secretive as it is, but Simons took it to another level.)

Simons will retire with a net worth of around $8.5 billion dollars.

James Simons and Renaissance Technologies made the news earlier this year when it was revealed that they had been an investor with Bernard Madoff, eventually pulling their money out of the fund after growing "distrustful" of Madoff and his returns.

In the end, Simons will likely best be remembered for his incredible mind and awe-inspiring returns over the past 20 years.

Source: WSJ.com - Hedge-Fund Legend Simons Will Retire

Photo: Oberwolfach

Filed under: General Market News