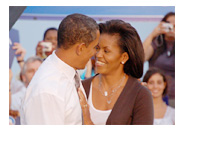

The Obamas Incurred a Federal Tax Bill of $98,169

If you are interested in such things, President Obama published his 2013 federal income tax return on Whitehouse.gov earlier today.

If you are interested in such things, President Obama published his 2013 federal income tax return on Whitehouse.gov earlier today. The Obamas, who jointly filed, reported total income of $503,183 and an adjusted gross income of $481,098 in 2013. Their total federal tax bill was $98,169, while their state income tax (Illinois) bill was $23,328.

Here is a breakdown of the Obamas' income for 2013:

Salary - $394,796

Taxable Interest - $6,575

Ordinary Dividends - $3

Business Income - $104,809

Capital Loss - ($3,000)

This resulted in a total income of $503,183. From this total, $1,404 was deducted for the deductible part of the self-employment tax, while $20,681 was deducted for self-employed SEP, SIMPLE and qualified plans.

The Obamas paid a total of $117,277 towards their federal tax obligations in 2013 and they elected to roll over the $19,108 refund to their 2014 taxes.

The Obamas contributed $59,251 to charities in 2013, with the Fisher House Foundation ($8,751) getting the largest contribution. Sidwell Friends School, CARE and One Fund Boston were some of the other charities that received donations from the Obamas in 2013.

--

As of May 14th, 2013, the Obamas had a net worth of somewhere between $852,013 and $6,380,999 (this doesn't include the value of a primary residence). Their biggest single asset was in the form of US Treasury Notes (valued between $1,000,001 and $5,000,000), while their only liability was a mortgage on their Illinois residence of between $500,001 and $1,000,000.

Source: Whitehouse.gov - President Obama and Vice President Biden's 2013 Tax Returns

Filed under: General Knowledge