Is the Current Housing Market One of the Biggest Bubbles in History?

In case you have been sleeping under a rock, the subprime mortgage industry in the United States has been absolutely taken apart in recent months. The rout in the sub-prime market has wiped literally trillions of dollars off of global share values, and the situation seems to worsen every day. More and more subprime and regular mortgage holders are simply walking away from their homes instead of continuing to pay them off.

In case you have been sleeping under a rock, the subprime mortgage industry in the United States has been absolutely taken apart in recent months. The rout in the sub-prime market has wiped literally trillions of dollars off of global share values, and the situation seems to worsen every day. More and more subprime and regular mortgage holders are simply walking away from their homes instead of continuing to pay them off.What happened? How did the situation get so bad? Anytime you get an ultra hot market of any kind, everyone wants in. Good credit risks and bad credit risks. Lenders became more and more generous with their lending. Home values continued to climb, so they didn't perceive that there was much risk in lending to people with poor credit histories. All sorts of shenanigans took place. Applications were fudged and sometimes forged in order for mortgages to be approved. People bought with no down payments. Loans such as the "2 and 28" became popular that would back-end load the mortgage payments, making it more attractive for people to get in now.

The first cracks in the housing industry came when sales started to slow down. When sales slow down, prices start to drop (not in every market, but overall.) People who bought with no money down and with sometimes predatory mortgage payment agreements suddenly saw their asset worth 10% less than what they bought it for. More and more homes were foreclosed, as people either walked away from their mortgages or simply couldn't or wouldn't pay the mortgages anymore.

The subprime mortgage industry was in big trouble. One by one, companies with exposure to the industry were taken apart. Subprime lenders either had to make last-second deals to ensure their survival or simply fold. Hedge funds with major exposure to sub-prime paper either took a beating or folded up shop.

As homes were foreclosed on and simply forgotten about, prices continued to drop. More supply equals less demand, excluding a few pockets of the country. Now regular mortgage holders were starting to see their assets decline and become worried about it.

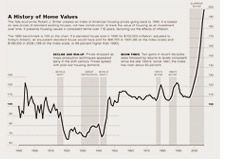

The current housing market reminded me a lot of the bull run in the late '90s in the stock market. At that time, everyone said that the market would continue to go up, basically forever, because stocks always go up over time. People say the same thing about real estate. All of a sudden, real estate was red hot. I mean, how many renovation and home flipping shows are there on TV now? Everyone wanted a career in real estate, just like everyone wanted a career in the stock market in the late '90's. And all of a sudden the real estate market became a national obsession, just as it had become for the stock market in the late '90s.

The good news is that if you are in the real estate market for the long-term, you have nothing to worry about. The industry will get through this current mess (will probably take years, but it'll get through it.) If you are in for the short-term, and you bought a house with the idea of flipping it over the next year, because you figure that the market is bound to continue going up; then you are probably in for a rude awakening.

Lending requirements will tighten, it will be harder for people to find buyers for their homes, and home prices will continue to tumble. Considering that most people have most of their net worth tied up in their homes, this can be a pretty scary thing to consider.

It's a Catch 22. The real estate market wouldn't have been nearly as hot if these bad credit risks hadn't been able to buy homes in the first place. But in the end, because of all of these foreclosures that will be hitting the market, the real estate market is bound to tumble.

When you have Jim Cramer, host of Mad Money on CNBC, advising people in "2 and 28" mortgages that were bought over the last two years to simply walk away from their homes, then you know that you have a problem. A herd mentality will be created, and people will want to get out of their homes at any cost. Opportunity will be created, although the short-term pain will be immeasurable. When you get a major TV personality advising people to simply walk away from their homes, then you have a major problem.

How much will real estate values decline over the next few years? Tough to say, but there will definitely be some pain. The American housing market, in my opinion, is certainly one of the biggest bubbles that we have seen over the past 100 years.

Filed under: Real Estate News | The Economic Meltdown