How Have The Major North American Stock Market Indexes Performed Short-Term After Very Bad Years?

The Dow Jones Industrial Average, Nasdaq Composite and S+P 500 have all performed very well since their inceptions. Of the three indexes, the Dow Jones Industrial Average was the only one that existed during the Great Depression. The Nasdaq Composite was launched in 1971, and the S+P 500 was technically launched in 1957, though it is possible to extrapolate the data back in time due to the indexes listing requirements.

The Dow Jones Industrial Average, Nasdaq Composite and S+P 500 have all performed very well since their inceptions. Of the three indexes, the Dow Jones Industrial Average was the only one that existed during the Great Depression. The Nasdaq Composite was launched in 1971, and the S+P 500 was technically launched in 1957, though it is possible to extrapolate the data back in time due to the indexes listing requirements.All three of these indexes are down 30-40% in 2008, which represents a historically awful years for all three indexes. Many people take comfort in the fact that the markets have always bounced back after bear markets, and that this time will be no different.

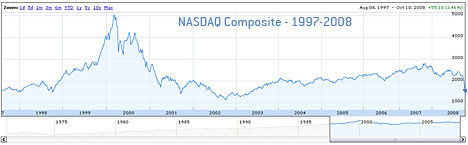

That may or may not be true - not be be too much of a downer, but a stock market index rebounding past its previous highs is not always necessarily a given. Just a couple of examples for you - the Nikkei 225 set an all-time high of around 39,000 in December of 1989, and has not come even close to matching those heights since. It currently sits at around 8,300 points. The Nasdaq Composite set an all-time high of over 5,000 in early 2000, and currently sits at 1,650 points over eight years later. You can't always count on the markets to bounce back, higher and stronger than ever, because it doesn't always happen.

Anyways, back to the DJIA, Nasdaq and S+P 500. I pulled all of the historical data from all three of the indexes. For the S+P 500, we will be using the extrapolated data that goes all the way back to 1928. For the Nasdaq, I will be going back to the mid 70s. A "very bad" year to me is a 20%+ down year.

Let's start with the S+P 500:

The S+P 500 was down 24.9% in 1930. The following year it lost an additional 43.4%. The year after that (1932), it lost an additional 8.2%.

The S+P 500 was down 35% in 1937, and rebounded strongly the very next year, closing up over 31%. It should be mentioned though, that the three following years were all down years for the index (-0.4%, -9.8% and -11.6%).

The S+P 500 was down 26.5% in 1974. 1975 saw a strong rebound, as the index traded up over 37.2%. 1976 was another strong year, with the S+P 500 adding an additional 23.9%.

Since then, the S+P 500 has done extremely well, and has not had any "bad" years (not counting 2008 of course).

Now, the Nasdaq Composite:

Since 1975, the Nasdaq has had three "very bad" years - 2000, 2001 and 2002. 1990 was a weak year for the index as well, as it lost a total of 17.8%. The three years that followed saw gains of 56.84%, 15.45% and 14.75%.

2000 saw the types of losses that we will end up seeing in 2008, as the index lost a total of 39.29%. The next year saw a loss of 21.05%, while 2002 saw a loss of 31.53% as companies struggled with a 9-11 inspired recession.

Now, the Dow Jones Industrial Average:

The Dow Jones Industrial Average fell 16.6% in 1973 and 27.5% in 1974. The next year (1975), the Dow Jones Industrial Average posted a very strong 38.3% return, followed by a 17.9% return the next year.

The DJIA fell 33.77% in 1930. Those hoping for a quick rebound were devastated after the DJIA posted a return of 52.67% the very next year, and a return of 23.07% in 1932.

The bottom line? Based on historical data, the REALLY bad years for the indexes tend to be followed by more losses, but this is not always the case. Those who are banking on an immediate turnaround may want to tread carefully over the next few years.

Filed under: The Economic Meltdown | Stock Market Education