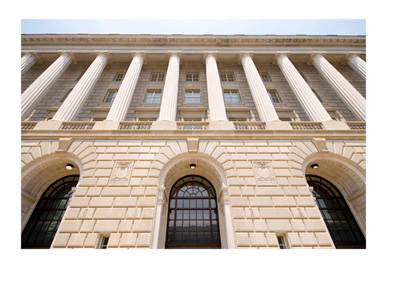

IRS Will No Longer Accept Check Payments of Over $99,999,999

Did you have a really good year in the markets last year and now owe the IRS more than $100 million? Did your business have a great year and now you have to cut a check for $150 million to the government?

Did you have a really good year in the markets last year and now owe the IRS more than $100 million? Did your business have a great year and now you have to cut a check for $150 million to the government?If so, the Internal Revenue Service wants you to know that they will no longer be accepting checks for over $99,999,999. If tax payment is going to be $100 million or over, you will either need to:

1) Wire money directly to the government

2) Write multiple checks

According to a representative from the Department of Treasury, the government is instituting this new policy for a number of reasons. The main reason, they say, is to prevent the possibility of fraud and errors, as any checks for over $100 million have to be processed by hand.

In addition, checks can be lost or stolen. It seems hard to imagine a company sending a check for over $100 million through the mail, but it must happen.

The government's check-processing equipment at Federal Reserve banks, according to the IRS, can not process checks for over $99,999,999.

-

In case you are wondering, the IRS says that a total of 14 checks were written for over $99,999,999 last year.

Filed under: General Knowledge