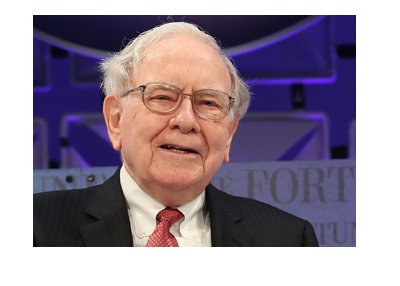

Warren Buffett Collects On His Market Wager Against Ted Seides

In 2007, Warren Buffett of Berkshire Hathaway bet Ted Seides of Protege Partners that a low-cost index fund would outperform a set of five "fund-of-funds" (funds that invest in various hedge funds) over an extended period (the bet would ultimately be for 10 years).

In 2007, Warren Buffett of Berkshire Hathaway bet Ted Seides of Protege Partners that a low-cost index fund would outperform a set of five "fund-of-funds" (funds that invest in various hedge funds) over an extended period (the bet would ultimately be for 10 years). Buffett's contention? The high fees charged by hedge funds would ultimately result in an under-performance of the market. Buffett would choose a low-cost Vanguard S&P 500 fund, while Seides would select an unnamed collection of "fund-of-funds". The results from these funds would be averaged and ultimately compared against the performance of the Vanguard S&P 500 fund.

The two men bet $1 million on the wager, with Buffett promising to donate any winnings to charity.

-

The result? It wasn't even close.

From 2008-2016, the S&P index fund gained a total of 85.4%, while the five "fund-of-funds" greatly underperformed.

Of the five FoFs, only two managed to gain more than 10%, with one gaining 62.8% (respectable) and the other gaining 28.3%. The other three fund of funds gained 8.7%, 2.9% and 7.5%, respectively. That's embarrassing.

When averaged together, the five FOFs underperformed the market so badly that Seides elected to throw in the towel on the bet early, as there was absolutely no chance that he would catch up.

The $1 million that Buffett won will reportedly be donated to Girls Inc. of Omaha.

-

Buffett's point in making this wager? Paying excess fees (usually 2 and 20) to a hedge fund is likely a bad idea, as a low-cost index fund will almost certainly outperform over the long-term.

Filed under: General Knowledge