Inverted Yield Curves Typically Precede Recessions

Over the past few days, you have likely heard the term "inverted yield curve" if you read a publication like the Wall Street Journal or watch any type of business news.

Over the past few days, you have likely heard the term "inverted yield curve" if you read a publication like the Wall Street Journal or watch any type of business news. Inverted yield curves fill economists with a sense of dread, as they have accurately predicted every recession in the United States since 1955, with only one false positive (in the 1960s).

After a period of time in which the yield curve has been "flattening", things have gotten worse in recent days, as the yield curve has officially inverted, which usually spells bad news for the US economy (or any economy in general).

-

What is an "inverted yield curve"?

In normal circumstances, the yield on a long-term Treasury note (10 years) is higher than the yield on a short-term Treasury note (2 years).

For instance - the yield (the return that an investor realizes on a note) for a 10 year Treasury note might be 2.95%, while the yield for a 2 year Treasury note might be 2.55%.

This is how things normally work.

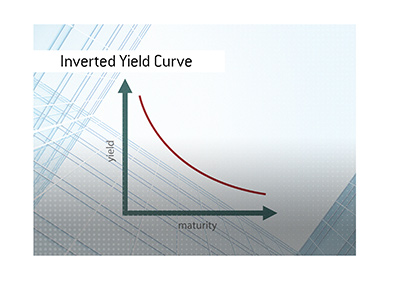

When the yield curve inverts, the short-term notes yield more than the long-term notes.

So, in the case listed above, the 10 year notes might yield 2.55%, while the 2 year notes might yield 2.65%.

This is not normal.

In a normal situation, the longer-term notes will yield more because there is more risk that a strong economy will result in higher inflation and higher interest rates in the future.

When the yield curve inverts, the bond market is telling you that traders believe that the economy is in danger and, subsequently, interest rates may fall in the future.

Despite what some may have you believe, falling interest rates are not necessarily a good thing, as they are usually implemented during periods of economic weakness.

So, an inverted yield curve is saying that there is potentially trouble for the economy lurking ahead. It's the closest thing to a flashing red light that you will see in the world of economics.

-

An inverted yield curve is not a guarantee of a pending recession, though it is a fairly strong indicator.

With the yield curve currently inverted, bond traders are essentially warning that economic growth is projected to be weak and that interest rate cuts may be on the horizon.

Filed under: General Knowledge