Short-Sellers Tortured By Retail Traders

What do you get when you combine a HEAVILY shorted stock with an investing public that is suddenly in love with options trading?

What do you get when you combine a HEAVILY shorted stock with an investing public that is suddenly in love with options trading?You get Gamestop.

It wasn't that long ago when Gamestop looked as though they would be going out of business. The stock was trading for less than $4 and the bonds were indicating that the company was in trouble.

Things started to change when Michael Burry (of "The Big Short" fame) announced that he was long millions of shares of Gamestop. He would add more shares to build on his initial stake, and eventually owned over 5% of the company.

After that, Chewy.com co-founder Ryan Cohen started accumulating a stake in the company. Cohen, who owns 13% of Gamestop, was recently appointed to the company's Board of Directors.

Despite these developments, many short-sellers continued to bet against the company. According to reports, well over 250% of the company's float had been sold short as of December 31st, 2020. This represented over 70 million shares that had been sold short. Melvin Capital Management LP, which has performed very well since its inception and is likely one of the most closely tracked hedge funds in the world, is one of the entities that has been short the company (they are currently short via puts, though they could also be short the common shares as well).

The fuse had been lit.

Enter the retail traders.

Over the past decade or so, retail traders have discovered options trading. The cost of trading options has dropped dramatically in recent years, and many traders have discovered their love for gambling via options.

These traders have continued to make bullish bets on Gamestop as the stock has risen, though things really went crazy this week.

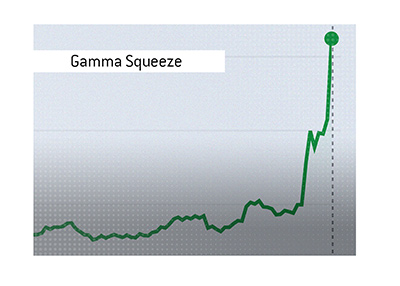

There is something called a "gamma squeeze" that we have seen in stocks like Tesla.

When you buy a put or call option, a market maker is usually on the other side of the trade.

Market makers don't want to be short tens of thousands of calls, so they usually buy shares of the stock to hedge their positions.

As more and more money pours into the calls, more shares have to be bought in order to hedge. This creates a squeeze - the "gamma squeeze".

So, on top of the retail traders that were buying, market makers were buying shares in order to hedge their call sales, and short sellers were getting blown out of the stock and being forced to cover.

Combine all of these things together and you had the result - shares of GME briefly trading over $70 per share before closing the day at $65.01.

-

The interesting part of this story is that these smaller traders are realizing their power to wreak havoc against short-sellers and market makers.

Filed under: General Knowledge