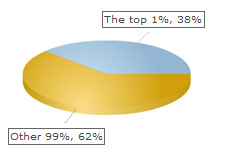

The Top 1% of Earners Paid 38.02% of Federal Individual Income Taxes in 2008

You probably hear people spouting off these types of stats all the time:

You probably hear people spouting off these types of stats all the time:"The top 1% of income earners in the United States pay XX% of the taxes"

I've heard this statement come out of a person's mouth many times over the course of my lifetime. Some people will claim that "rich" people pay 50% of all individual income taxes in the country, while others will go as high as 60, 70, 80 or even 90%!

What is the truth?

What better place to go to find out the answer than the IRS (Internal Revenue Service). Taxfoundation.org has developed a couple of easy-to-follow charts based on the data provided by the IRS - I have provided a link to Taxfoundation.org below.

According to the IRS, the "income split point" for somebody to be included in the top 1% of all taxpayers (by income) was $380,354 in 2008 (the last year where data is available).

So, if you reported Positive Adjusted Gross Income (AGI) of $380,354 or over, then you were in the top 1% of all taxpayers in the United States in 2008.

According to the IRS, this group of taxpayers (1,399,606 total) paid 38.02% of all federal individual income tax collected in 2008.

The top 5% of all taxpayers (income split on this group was at $159,619 in 2008) paid 58.72% of all federal individual income taxes in 2008.

Let's continue to break this down:

Top 10% (Income Split Point $113,799) Paid 69.94% of Federal Individual Income Taxes

Top 25% (Income Split Point $67,280) Paid 86.34% of Federal Individual Income Taxes

Top 50% (Income Split Point $33,048) Paid 97.30% of Federal Individual Income Taxes

Bottom 50% (Anyone Making Less Than $33,048) Paid 2.7% of Federal Individual Income Taxes

--

A few other interesting nuggets of information for you:

-top 1% of earners in 2008 brought home 20% of adjusted gross income but paid 38.02% of all federal individual income taxes

-top 1% of earners paid 40.4% of federal individual income taxes in 2007

-the top 0.1% of earners in 2008 (140,000 tax returns) paid 18.5% of federal individual income taxes

-the average income of this group in 2008 was approximately $6 million

--

There you have it, courtesy of the IRS.

Source: Taxfoundation.org - Summary of Latest Federal Individual Income Tax Data

Filed under: General Knowledge