Markets Have The Fed To Thank For Their Gains in 2010

If you had been marooned on an island somewhere over the past few years and heard that the three major US market indexes (DJIA, NASDAQ, S+P 500) had all posted double-digit percentage gains in 2010, then you would probably think that people would be fairly happy.

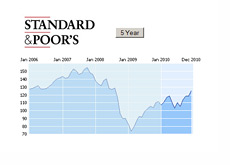

If you had been marooned on an island somewhere over the past few years and heard that the three major US market indexes (DJIA, NASDAQ, S+P 500) had all posted double-digit percentage gains in 2010, then you would probably think that people would be fairly happy. You would note that the major market indexes have recovered to pre-Lehman Brothers collapse levels and that the economy is finally starting to show signs of life after nearly three years in hibernation.

However, despite the fact that the DJIA (+11%), S&P 500 (+12.8%) and NASDAQ (+16.9%) all posted double-digits gains in 2010, there is still a sense of nervousness and uncertainty in the markets right now.

Sure, the markets performed well in 2010, but let's not forget about the stimulative measures that were enacted by the Fed earlier in the year. The Fed's actions certainly goosed the markets higher in the second half.

On the other hand, the economy finally seems to be gaining some positive momentum after three moribund years (2008-2010), which had led many market observers to call for substantial gains for the DJIA, NASDAQ and S&P 500 in 2011.

This optimism is not shared by many average US citizens though as they peruse their stock holdings at the end of the year. Sure, the talking heads on TV say that the economy is improving, but Joe Average is going to look at:

-a 9.8% national unemployment rate

-uncertainty surrounding the value of their home

-steadily rising gas prices

-sky-high national deficit and debt levels

-geopolitical uncertainty (Koreas, etc)

and probably have some serious doubts as to the near-term direction of the markets.

To many people, the markets felt very manipulated in 2010, and they would be right. In the past, the optimism and enthusiasm of the average investor has propelled the markets higher as they have flooded the markets with their money. In 2010, it was something different.

As it stands right now, the optimism just isn't there. After three years of getting beat down, the average investor just doesn't believe in a full-blown recovery taking place anytime soon. Even if they did believe in a full-blown recovery taking place, many investors simply don't have the finances to put money to work in the markets right now. Many people have seen their net worths obliterated due to a falling real estate market, extended periods of time without employment, etc.

In short, the gains that were posted in 2010 just felt "off" to many people, and I'm not sure that they are buying the idea of continued gains being posted over the near-term.

If I were going to sum up the 2010 gains in two words it would be "nervous" and "manipulated".

It is going to be very interesting to see what 2011 has in store for the markets.

Filed under: General Market News