St. Louis Fed: Only 45% of Household Wealth Has Truly Been Recovered

According to the Federal Reserve, aggregate household wealth in the United States was $66.1 billion at the end of 2012, slightly lower than the pre-"Great Recession" peak of $67.4 trillion.

According to the Federal Reserve, aggregate household wealth in the United States was $66.1 billion at the end of 2012, slightly lower than the pre-"Great Recession" peak of $67.4 trillion. Great numbers, right? US households have almost fully recovered from the "Great Recession"!

Not so fast. According to the St Louis Fed, things aren't nearly as rosy as the Federal Reserve numbers may make them seem.

According to the St. Louis Fed, the numbers are misleading for three reasons:

1) They don't account for inflation

2) They don't account for population growth

3) They don't account for the fact that a full 62% of the increase in aggregate household net worth between Q1/2009 and Q4/2012 has come as a result of the surging stock market. According to the St. Louis Fed, "stock wealth is unevenly held, with the vast majority of stocks owned by a relatively small number of wealthy families." So, in other words, the recovery in aggregate household net worth has not been spread evenly across the country.

--

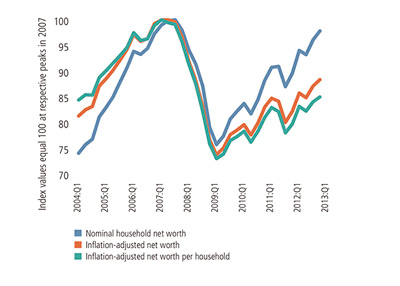

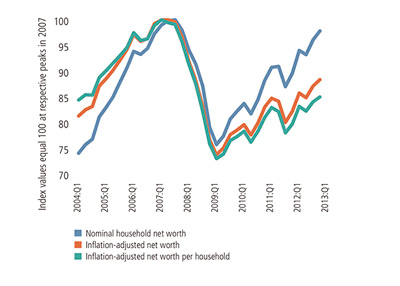

Nominal net worth has recovered 91% since before the "Great Recession".

After adjusting for inflation, this figure, according to the St. Louis Fed, drops to just 56%.

After adjusting for inflation and population growth (there are more households now to share this aggregate household wealth), this figure drops to 45%.

So, if you are hearing in the media about how household wealth has almost fully recovered but you aren't feeling that wealthy yourself, don't be discouraged - according to the St. Louis Fed, the numbers are fairly misleading.

Source: StLouisFed.org - After the Fall: Rebuilding Family Balance Sheets, Rebuilding the Economy

Filed under: General Knowledge