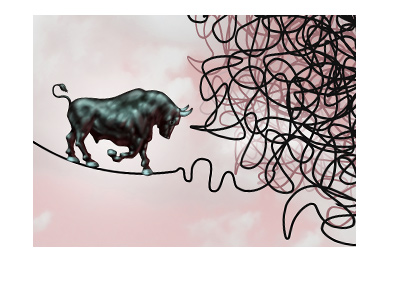

Is The Bull Finally Dead or Is This Just Another Buying Opportunity?

Over the past eight years, every "dip" in the market has been met with ferocious buying. Anybody who has bought the dips has done extremely well for themselves, in the face of whatever geopolitical news may be dogging the markets. One thing has been for sure during this bull run - the bull has proven to be indestructible.

Over the past eight years, every "dip" in the market has been met with ferocious buying. Anybody who has bought the dips has done extremely well for themselves, in the face of whatever geopolitical news may be dogging the markets. One thing has been for sure during this bull run - the bull has proven to be indestructible. Why has so much money flooded into the markets over the past eight years? The answer is simple - the chase for yield. With interest rates near rock bottom, bonds have provided practically zero returns for investors. With a growing economy and rock bottom interest rates, the US markets have proven to be an exceptionally great place to be over the past eight years.

Over the past week, the markets took a serious tumble, with the Dow Jones Industrial Average dropping by over 650 points on Friday.

The main worry? That rising bond rates are going to pull equity investors away from the NASDAQ, DJIA and S&P 500.

-

It's a double-edged sword - rock bottom interest rates are not a good thing and are indicative of an economy that is in a precarious position. The reverse of that, however, is that low interest rates can translate into fabulous returns for equity investors as companies find it cheap to borrow money (for buybacks, dividends, acquisitions, etc) and investors find it very tempting to sink their money into the markets, as yield is generally not available elsewhere.

Rising interest rates mean that the economy is strengthening and that less stimulus is needed. 4.1% unemployment is translating into higher wages, which means that inflation is finally starting to tick higher, which means that bond yields are finally starting to rise. 3% Treasury yields are going to be a game-changer, and the market is starting to fret as a result, especially after a historic rise in the markets since the "Great Recession".

-

The markets are likely going to be volatile as investors go through a tug-of-war.

Bullish investors will point to significantly lower corporate tax rates, massive amounts of repatriated cash and increasing wages as reasons why the bull market should continue.

Bearish investors will say that the low interest rate party is coming to an end, and that in addition to many investors seeking out rising bond yields as a way to limit exposure to a long-running bull market, companies will be less willing to borrow money to pay for share buybacks and dividends, which help to juice share returns.

-

There seems to be little risk of a recession for the next few years in the United States, as numerous major companies will be deploying significant amounts of repatriated cash to build new plants and hire new people.

The question becomes - how high will interest rates have to rise to fend off growing inflation, especially if wages continue to rise, and what will this do to the bull market?

Filed under: General Knowledge