Trader Pocketed Millions in Couple of Hours

During the 35-day partial shutdown of the US federal government, the SEC was operating with a greatly reduced staff.

During the 35-day partial shutdown of the US federal government, the SEC was operating with a greatly reduced staff. When members of the SEC staff return to work on Monday, some of them will very likely be dispatched to investigate two highly suspicious options trades that took place in PG&E this past week.

Shares of PG&E, an electric utility company, have been savaged in recent months due to the liabilities that will likely be incurred by the company thanks to a number of California wildfires. The company is being investigated for causing the Camp Fire, which ended up being the deadliest and most destructive wildfire in California history. The company is being sued by multiple victims in San Francisco County Superior Court, as it is being alleged that the company was negligent due to failing to properly maintain its infrastructure and equipment. This negligence, it is being alleged, ended up causing the deadly fire.

This potential liability is enough to bankrupt the company, and shares have fallen to the single digits as a bankruptcy filing was thought to be more likely by the day.

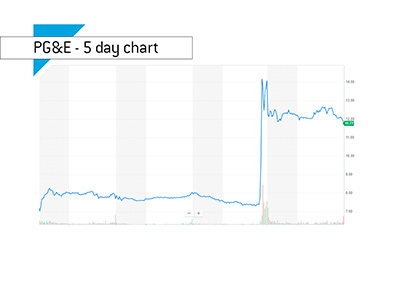

Earlier this week, the California Department of Forestry and Fire Protection clearly the company of the Tubbs Fire in 2017, stating that the fire was ultimately caused by a private electrical system. Shares of PG&E soared by 75% on the unexpected news - the climb higher was likely exaggerated by algorithmic trading programs that were piling in on the news.

This news did not absolve the company of responsibility for other fires, namely the Camp Fire, which still threatens to bankrupt the company. For this reason, the move higher was thought to be dramatically overdone.

-

A short while before the news was released, a trader purchased 10,000 February 8th $12 call contracts for $200,000. With shares of the company trading for about $7.50 at the time, this was an extremely optimistic wager that the company's shares would spike dramatically higher in a short period of time.

After the news was released, shares of the company spiked and these options were suddenly worth $3.7 million. Not bad for a few minutes of work!

In addition, somebody bought 10,000 of the February 1st $10 calls the day before, laying out a total of $300,000. These options would end up being worth $4.7 million.

Industry experts claim that these two trades were almost certainly executed by the same person or entity.

-

It seems hard to imagine that somebody would risk this type of premium if they didn't possess insider news.

Maybe they were hoping that the shutdown would result in the SEC forgetting about these trades, and that they would slip off with their millions of dollars in gains.

Or maybe it was a true "lotto" trade, in which case they better have a very good story ready for the SEC, who will undoubtedly come calling later this week.

Filed under: General Knowledge