$1.84 Trillion Dollar Deficit Expected in Current Fiscal Year

Everyone knew that the United States was going to have an eye-popping deficit this year.

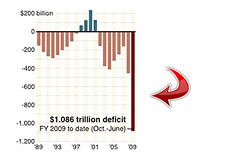

Everyone knew that the United States was going to have an eye-popping deficit this year.However, when the Treasury Department reveals that the US has racked up $1 trillion dollars in deficit spending so far this year (and the year isn't over), the information tends to hit you over the head like a ton of bricks.

Earlier today, the Treasury Department revealed that the United States had posted a $94.3 billion dollar deficit in June.

This means that since the beginning of the budget year (October), the United States has spent $1.09 trillion dollars more than they have collected in revenues.

When all is said and done, the US may very well end up with a $2 trillion dollar plus deficit for the current fiscal year. Keep in mind that the government currently estimates that we will end up with a $1.84 trillion dollar deficit by the time the fiscal year is out.

This is the first time that the United States has ever had a deficit of over a trillion dollars.

The largest deficit ever posted prior to this year was $455 billion dollars (2008).

Let's give this $1.84 trillion dollar figure some perspective.

In 1943, at the height of WWII, the United States posted a $669 billion dollar deficit (in inflation adjusted dollars).

That means that the 2009 number could be almost THREE TIMES this amount, when all is said and done.

In 1983, when Ronald Reagan and his government were battling a severe case of stagflation in the United States, the US ended up posting a deficit of $442 billion dollars (in inflation adjusted dollars).

At the time, many people were shocked and astonished by just how far into the red the US government was running in order to stabilize the economy.

In 2000, at the height of the dot-com boom, the United States posted a surplus of nearly $300 billion dollars in inflation adjusted dollars. Running a surplus in this day and age seems almost too absurd to even consider.

The Obama administration is predicting large deficits as far as the eye can see. In a decade, the United States is expected to have a public debt load of nearly $20 trillion dollars. (note: for an explanation of debts vs deficits, please click here).

Deficit spending in the United States has long passed the absurd stage; most people are pretty numb to the whole thing at this point. Tax revenues are falling, the costs involved in stabilizing the global economy continue to be exorbitant, and there are still two very costly wars being fought in Afghanistan and Iraq.

The government needs to rein in deficit spending at some point, or else there will end up being extremely serious consequences.

The cost to service the ever-expanding debt grows in leaps and bounds every year.

Other countries (namely China) will likely look to invest elsewhere if the US continues to run up massive deficits.

The United States may eventually suffer a downgrade in their credit rating if this continues - this will serve to make the cost of borrowing even higher for the nation.

The dollar will very likely crack under the strain.

What does the future hold for the United States?

Will they get their economy back on track?

Or will the country eventually buckle under the strain of a massive debt load?

Source: US Department of the Treasury

Filed under: The Economic Meltdown