Think that the SEC Is Corrupt? Meet Gary Aguirre

I've always had an inkling that the SEC as an organization is largely corrupt. There are quality people working at the agency to be sure, but when the people at the top of the SEC are willing to un-do months and months of work by their own people and kowtow to rich and powerful people with high-powered lawyers and political connections, there is something seriously wrong. The story of Gary Aguirre involves one person trying to pursue the truth and do the right thing, only to be thwarted and eventually fired by those in power.

I've always had an inkling that the SEC as an organization is largely corrupt. There are quality people working at the agency to be sure, but when the people at the top of the SEC are willing to un-do months and months of work by their own people and kowtow to rich and powerful people with high-powered lawyers and political connections, there is something seriously wrong. The story of Gary Aguirre involves one person trying to pursue the truth and do the right thing, only to be thwarted and eventually fired by those in power.The story starts with Pequot Capital. Pequot Capital is a multi-billion dollar hedge fund that is run by Arthur Samberg.

Arthur Samberg is a rich and powerful man with many connections. One of those connections was John Mack, current chairman and CEO of Morgan Stanley and also known as "Mack the Knife." Mack is very friendly with the Bush Administration, and is a major Republican party contributor. John Mack is probably one of the most powerful men in America.

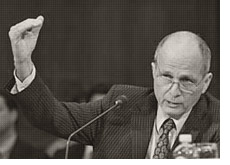

Before we get into the Samberg/Mack story, let's meet Gary Aguirre. Gary is a new hire for the SEC, and is a staff attorney. Aguirre will spend years investigating Samberg and Mack. Aguirre can be a little gruff and hard to deal with, but he has the best of intentions and believes that he can make a difference when it comes to policing the securities market. Aguirre is extremely bright and works tirelessly at his job.

Aguirre alleges that Mack and Samberg are friendly. Mack is an investor in several of Samberg's funds. Mack has access to information that most of the public would not have.

Aguirre alleges that Mack tipped Samberg off to an upcoming acquisition of Heller Financial by GE. Aguirre points to the fact that the two of them had gotten friendly, and just a few weeks later, Samberg had made a major purchase of Heller Financial (over a million shares) and had shorted GE. On the day that Heller Financial was in fact purchased, Samberg unloaded his entire Heller Financial position for about $18 million dollars of profit. If Mack did in fact tip Samberg off, Mack would have profited as well, not only financially, but he also would have curried favor with Samberg. At the time, Mack had just left Morgan Stanley.

The SEC identified 17 "suspicious" transactions involving Pequot Capital (oh really?). The SEC decided to just focus on a few of the transactions, including the Heller Financial purchase. Gary Aguirre, a fresh SEC hire who was on a one year probation, was assigned to the case.

Now, the point of this article isn't to try to determine whether or not Samberg and Mack are guilty. The point of this article is to detail the lengths to which the SEC went to protect these two men and besmirch the good name of a person who was just seeking the truth. Is Samberg guilty? Probably. Samberg confessed to have not followed Heller Financial, and couldn't point to any one analyst report that would have tempted him to take a long position. I find it highly unlikely that someone would take a huge position in a company if they were unfamiliar with it, especially someone that runs a multi-billion dollar hedge fund.

Now, years went by, and in Gary Aguirre's opinion, he was building up a pretty solid case against both Samberg and Mack. The investigation seemed to be gaining momentum, with several higher-ups at the SEC signifying that they thought the accusations of a tip-off involving the two men had merit, and that a criminal investigation could soon be launched.

This is where attorneys for Pequot and Morgan Stanley stepped in. They took their conversations straight to the Director and Associate Director of the SEC. Gary Aguirre's bosses, who had just recently strongly supported his case, suddenly had an about-turn. SEC managers ordered the investigation to be narrowed.

Gary Aguirre and other underlings at the SEC had wanted to subpoena and interview John Mack. Aguirre had once been warned by a higher-up in the SEC that Mack had "juice", meaning that he would be able to talk directly to the Director and Associate Director of the SEC. This is exactly what happened. Suddenly, SEC managers were dragging their feet in regards to interviewing Mack. Through a variety of excuses and delays, SEC managers managed to delay the interviewing of Mack until just days after the statute of limitations had expired. At that point, there was really no point in conducting an interview.

Mack eventually did testify in this matter, but only when this case has become public and the Senate started to investigate. Without the Senate becoming involved, Mack never would have been interviewed and would have remained protected by the SEC managers.

Aguirre raised a stink about the turn of events to his bosses at the SEC. Why, Aguirre asked, were we dumping this investigation after you had just told me that criminal charges were probable against Samberg and Mack? His managers never replied.

Aguirre received positive commendations during his time at the SEC, and had been recommended for a "merit increase" (pay raise) due to his hard work. He received glowing words from his boss at the SEC. Aguirre then went on vacation, and by the time he had come back, he had been fired from his job, despite glowing reviews and a recommendation for an increase in pay. Technically Aguirre was still under probation and could be fired for any reason. Aguirre contends this was done to punish him because he was forceful in wanting to continue the investigation against Mack and Samberg. It's hard to argue when you read the Senate findings.

The SEC decided to "re-evaluate" Aguirre, which is very unusual for them. Suddenly Aguirre received a negative evaluation. Only one other time had the SEC taken this course and negatively re-evaluated an employee, and it was for the same reason; this employee had complained about lawyers for someone under investigation talking directly with the director of the SEC. In this case as well, the employee was fired.

When Aguirre complained about being fired, his letters and emails were largely ignored. Aguirre was to be swept under the rug, along with the case against Mack and Samberg.

On October 5th, 2006, the SEC recommended that no action be taken against Mack. In November, the SEC notified both Mack and Samberg that the file had been closed, and that they would not be facing charges.

Last summer, news of this potential insider trading scandal broke, but was almost immediately buried. Now, more and more is coming out about this story, and it is a story that must be told. Where there is smoke, there's fire, and I believe that there is something here. With the Wall Street Journal recently reporting on this story, it has the potential to become a major news item once again.

The questions I have are:

1. Is the SEC and its senior managers that beholden to the current administration of the United States?

2. Why was Aguirre fired if, by all accounts, he was a model employee?

3. What will happen with the other "suspicious transactions" that Pequot Capital was involved in?

4. How much of this high-level negotiating between high-powered lawyers and SEC directors takes place every day? What potential explosive investigations are being buried?

5. How are we supposed to effectively police our markets if this kind of corruption is taking place?

6. How are we supposed to hire quality people to work at the SEC if they are going to be muzzled and subsequently fired for asking the wrong questions?

7. How does Samberg account for the Heller Financial purchase? Why did he also choose to short GE at the very same time?

8. If Mack were in fact innocent, why all the hassle to avoid having him interviewed by SEC staff? And why is SEC management going to all this trouble to have Mack not be interviewed?

9. Why did high-level SEC managers disclose sensitive information regarding the investigations to the lawyers of those under scrutiny?

10. Will anything be done about this case or will it simply fall through the cracks?

Filed under: Stock Market Scandals