What Is a Short Squeeze?

The term "short squeeze" has been bandied about quite a bit in the media as of late, especially when referring to the current situation involving Porsche and Volkswagen.

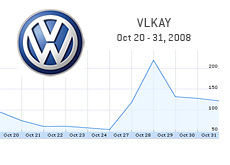

The term "short squeeze" has been bandied about quite a bit in the media as of late, especially when referring to the current situation involving Porsche and Volkswagen.Volkswagen's shares exploded earlier this week as the result of a major "short squeeze." Volkswagen traded from approximately 210 euros to just under 1000 euros over the course of just a couple of days. For a short period of time, Volkswagen was the most valuable company in the world, topping the likes of Exxon Mobil, Microsoft and General Electric.

In quick and simple terms, a "short squeeze" is when short-sellers in a company are forced to cover at a higher price.

The optimal conditions for a legitimate "short squeeze" include: a heavily shorted stock with a small float that releases some type of positive news. You are not going to get a "short squeeze" in stocks that do not have heavy short positions relative to their floats. You might look at Microsoft and think that they are candidates for a "short squeeze" because there are currently 61.21 million shares of the stock short. However, you need to also look at the percentage of shares short versus the float - in Microsoft's case, this is just 0.90%. There is always going to be plenty of liquidity in Microsoft's shares due to the size of the float - lack of liquidity is always a big contributing factor to a "short squeeze."

Let's look at another example.

BARE is a company that currently trades on the Nasdaq. As of October 10th, 2008, the company had a float of 64.49 million shares. Of these shares, a full 14.98 million were short, or 18.10%. BARE is a candidate for a short squeeze, but Microsoft is not.

Having said that - on the day that I am writing this, BARE just dropped over 38% due to poor third quarter earnings. Stocks have large short positions for a reason - hedge fund managers and other traders (who are usually very astute and knowledgable) strongly believe that the stock is heading lower. Companies with large short positions are usually very much in trouble. I just mention this so that you don't go around buying up the stock of companies with large short positions so that you can profit from a "short squeeze". Companies with large short positions are usually very distressed - short-sellers won't mess around with strong companies with strong balance sheets and growing businesses. They'll focus on those businesses that are most likely to fail.

The thing is, sometimes these distressed and "sick" companies will surprise short-sellers by announcing good news. In the case of Volkswagen, hedge fund managers were of the opinion that Volkswagen was overvalued. However, they were caught flat-footed by the announcement that Porshe would be expanding their ownership of Volkswagen. Two days of hectic trading later, Volkwagen is the most valuable company in the world and hedge funds have sustained many billions of losses.

Volkwagen was a perfect situation for a short squeeze. You had a large short position and very little liquidity in the stock (especially after Porsche announced that they had an option to own 75% of the company). Hedge funds raced to cover their large positions, but there are no liquidity (ie sellers) to bail them out of their positions. So before they knew it, their profitable short positions were ravaged overnight. Try covering a million share position in a stock with little to no liquidity. There is a reason why Volkswagen quadrupled in two days, even though it was already a company with a large market cap.

Short squeezes involve companies with large short positions compared to their float, and normally some sort of unexpected positive news or fundamental (positive) change in their business.

Filed under: Stock Market Education | General Knowledge