Treasury's $13.5 Billion Dollar Gain in Citigroup Common Shares Evaporates in Two Months

The US government currently owns a massive 7.7 billion share position in Citigroup.

The US government currently owns a massive 7.7 billion share position in Citigroup. These common shares, which were obtained in exchange for $25 billion dollars worth of TARP funds, were obtained at $3.25 per share earlier in the year.

If you are a resident of the United States, then you, by extension, are also a large shareholder in Citigroup.

1-2 months ago, it appeared as though the large block of Citigroup common shares would earn the government a nice tidy profit.

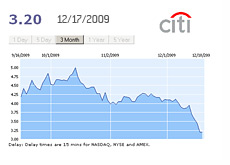

On November 18th, Citigroup closed at $4.29 per share. This meant that the US government was sitting on an unrealized profit of nearly $8 billion dollars. Not bad at all.

On October 14th, Citigroup closed at $5.00 per share. This meant that the US government was sitting on an unrealized gain of around $13.5 billion. Even better.

Since mid-October, Citigroup's stock has been in a freefall. Banks have been exiting the TARP program one by one, and investors started to realize that Citigroup would almost definitely follow suit. The cost would likely be an expensive share offering that would dilute existing shareholders in the company.

This is exactly what happened, as Citigroup sold 5.4 billion shares at $3.15 per share this week.

The Treasury Department elected not to sell any of their shares in the offering, preferring to wait at least a couple of months, hoping to be able to unload at a higher price.

Citigroup closed at $3.20 today, meaning that not only has the government's $13.5 billion dollar gain in the common shares been wiped out, but they are actually losing money in their position now.

In addition, Citigroup's dilutive offering means that the Treasury now owns a 26% stake in the bank, rather than the 34% that it had held earlier in the week.

The Treasury Department is hoping that Citigroup recovers in price so that they can dump their shares at a profit, but this may be wishful thinking.

The market knows that the Treasury is looking to dump their 7.7 BILLION shares over the next year or so (at least a substantial portion of their holdings). This fact, along with the increased number of outstanding shares thanks to the offering this week, should effectively put a cap on Citigroup's shares for the foreseeable future.

So, to recap - the US taxpayers fronted tens of billions of dollars to bail out Citigroup.

Citigroup decides to repay the TARP funds in order to "remain competitive".

In order to raise the funds to repay the TARP money, Citigroup completes a massive share offering that dilutes existing shareholders in Citigroup (of which the US taxpayer is the single largest shareholder).

The good news is that Citigroup is now free to lavish untold riches on its executives once again so that it can remain "competitive".

Could this entire situation possibly have been handled any worse?

Source: Treasury Pulls Plug on Immediate Sale of Citigroup Shares

Filed under: General Market News