Who Is Buying US Debt Issues?

How is the United States able to borrow trillions upon trillions of dollars?

How is the United States able to borrow trillions upon trillions of dollars?Who is lending them all of this money?

These are some of the most common questions that I receive by email on this site, so I thought that I would devote an entire post to the topic.

As you are probably well aware, the United States has decided that the best way to tackle the problems of a collapsing economy and crumbling banking system is to throw money at it. Trillions upon trillions of dollars.

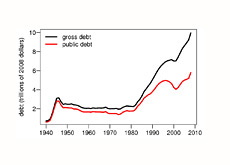

This is on top of the trillions upon trillions of dollars that the US government already owes in outstanding debt. As of this second, the total US national debt is around $11.17 trillion dollars. For an up to the second accounting of the total US national debt, you can visit our U.S. National Debt Clock page.

This number is expected to continue to spike over the coming years.

The Congressional Budget Office recently released a report in which they claimed that the total debt could reach $17.2 trillion dollars by 2019.

This is obviously a staggering sum of money.

What's more incredible is the amount of money that the US government (and by extension, the citizens of the United States) pay every year to service this debt. Hundreds of billions of dollars is paid out every year to service the ever-growing US debt load. Paying interest on debt is one of the biggest expenses of the US government, and this number will just continue to grow as the debt load grows.

Ok - so we have trillions of dollars being added to the US debt load every year.

Who is buying all of this debt?

And why are they buying it?

There are many different entities that purchase US debt.

Mutual funds. Foreign governments. Individual investors. Pension funds. The Federal Reserve. Hedge funds.

China itself owns around $739 billion dollars of US debt.

Japan owns around $635 billion dollars worth, while a number of other countries (including the UK, Brazil and Russia) all hold $100 billion dollar plus positions in US debt.

Heck, the Federal Reserve just announced their intentions to purchase $1.2 trillion dollars worth of government bonds and mortgage-related securities in an effort to lower borrowing costs.

That's right - the Federal Reserve is buying US debt. How are they paying for it? They are simply printing money. Just adding a few zeroes to their electronic ledger.

Anyways, these are the entities that currently own the $11 trillion dollars plus of US debt.

Now, the answer to the second question.

Why is there such a large demand for US debt?

Why have countries such as China, the UK and Russia significantly added to their holdings over the last number of years?

The main reason - US government debt is still considered to be the safest, most liquid investment in the world.

If you are a foreign government and need to park $50 billion dollars somewhere, where are you going to put it if you have zero tolerance for risk?

Currencies? No way.

Commodities? You could buy gold and oil, but you might lose money on your investment.

Stocks? Not a chance.

Real estate? Much too illiquid and volatile.

Debt of other nations? Which country has a more insatiable appetite for taking on debt than the United States? The answer? No one.

If you want to park money in an ultra-liquid and "safe" investment, then you choose US debt.

Why else would US treasury security issues constantly be oversubscribed, even though they will yield little to no returns? Investors (including foreign governments) are more interested in preserving capital at this point.

Will foreign governments, individual investors and the like ever lose their appetite for US debt issues?

It's a possibility. This would represent a doomsday scenario for the US government, and would likely result in massive inflation (assuming that the Fed would simply print money to purchase treasury issues).

With trillions of dollars in deficits expected over the next couple of years, the US debt load will continue to spike higher.

Will there ever come a day when the United States begins to pay off their massive debt load, or will they perpetually rely on debt issues in order to pay for their deficits?

Filed under: Stock Market Education