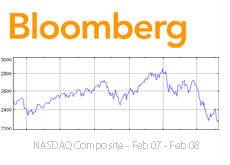

Insider Buying Signaling a Major Bottom in the Market?

According to Bloomberg, CEO's, directors and other senior officials are buying more shares in their companies than they are selling for the first time since 1995. The importance of this fact is that the last seven times that insiders have bought more than they have sold, the markets have rallied, and rallied rather furiously, for an average gain of 21% over the following 12 months.

According to Bloomberg, CEO's, directors and other senior officials are buying more shares in their companies than they are selling for the first time since 1995. The importance of this fact is that the last seven times that insiders have bought more than they have sold, the markets have rallied, and rallied rather furiously, for an average gain of 21% over the following 12 months.Bloomberg points out that insider purchases outnumbered insider sales by 1.44 to one. If this historical data is any indicator, then the S + P 500 should rally over the next twelve months.

Many people are questioning how accurate this data really is. Perhaps insiders are simply being naive and underestimating the severity of the economic downturn that we are currently going through?

On the other hand, no one knows their company's current financial and business situation better than a company insider. If an insider is buying, isn't that a clear indication that sunnier times are ahead for a company? As far as I know, company insiders don't particularly like to lose money, and they wouldn't be buying shares in their companies unless they thought that they were undervalued.

Q4 earnings are markedly lower so far; however, does this mean that earnings will continue to weaken going forward, or are we already at or near a market bottom caused by the subprime mortgage and housing market collapse?

All I know is this - it's pretty hard to bet against company insiders when they are buying.

Source: Bloomberg

Filed under: General Market News | Stock Market Education