Investors Jittery - For Good Reason

On August 4th, 2008, the Dow Jones Industrial Average closed at 11,734.32.

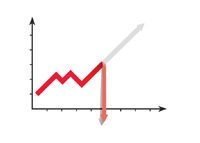

On August 4th, 2008, the Dow Jones Industrial Average closed at 11,734.32. Over the course of the next seven months, global equities markets crashed. The Dow Jones Industrial Average was no different, shedding over 5,000 points from August until early March.

Yesterday the Dow Jones Industrial Average closed at 11,896.44. Today, the DJIA lost over 500 points (-4.31%) to close at 11,383.68. That's the largest single day selloff since the dark days of 2008.

Combine today's results with the results from the last 9 trading days and you have a drop of over 10%. That's the traditional definition of a market correction.

Are we in for more than just a correction?

Given everything that the US and global economies are currently dealing with, we are going to be getting off pretty lightly if this current downturn ends up just being a correction.

A full-blown debt crisis in Europe. Decreased trust (if that is even possible) in Washington after the "debt ceiling" fiasco. Continued worries that the United States will lose its AAA credit rating. Growing worries that the United States is about to slip into a double-dip recession. These are just some of the issues that are on the minds of investors right now.

The possibility of a double-dip recession in the United States is very, very real. After all, just look at the Q1 and Q2 GDP growth numbers that were just released - if these figures don't leave you nervously twitching, then I don't know what will.

The US job market is horrible right now. We are almost four years out from the start of the "Great Recession", and the unemployment rate is still over 9% and going in the wrong direction.

Consumers aren't spending any money, as evidenced by Q2 consumer spending numbers. High energy and food prices are putting the squeeze on an already embattled US household.

Despite sitting on record piles of cash, many companies are choosing not to put it to work. With slackened demand from consumers, many companies are choosing to just sit and wait.

In addition, the recent debt ceiling agreement did practically nothing to slow down the country's runaway deficit spending. At this pace, it won't be long until we are talking about raising the country's debt ceiling to over $20 trillion.

And, as if all of that wasn't enough, Europe is still in the midst of a full-blown debt crisis.

--

There is a reason why the markets crashed today. Investors are worried, and for good reason.

Filed under: The Economic Meltdown